september child tax credit payment short

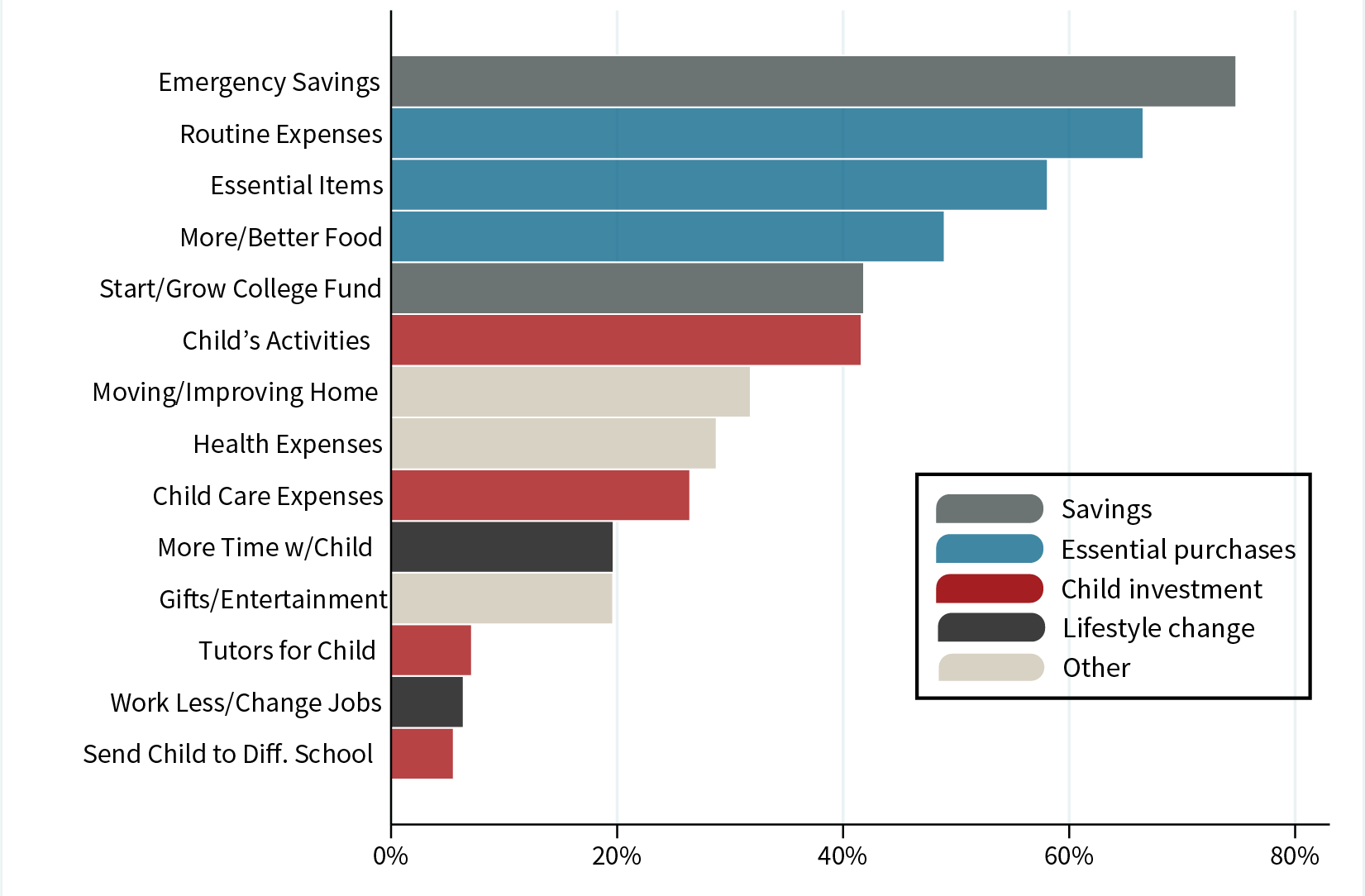

The next child tax credit payments will start arriving on September 15. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Each month the payments will be either 300 or 250 for each.

. Families can receive 50 of their child tax credit via monthly payments between. But not everyone got their money Friday and oddly. WJW While some parents didnt receive the September child tax credit payment because of a glitch in the system last month others did get a payment in their hands.

Millions of families across the US will be receiving their third advance child tax credit. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Eligible families who do not opt-out will receive 300 monthly for each child under 6.

September 17 2021. There are reports however the September payment was short or did not. 15 payment of the child tax credit on Friday.

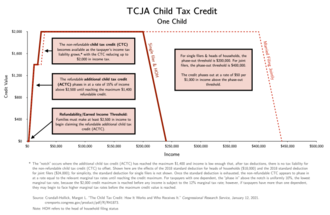

The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600. The installment which had already been under. Subsequent stimulus checks will be sent to households on October 15 November 15 and December 15.

The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17. What should you do if you havent received a payment or got the wrong amount.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. AMERICAN families have complained that they have been shorted money in their September child tax credit payment. The Internal Revenue Service IRS has made 2021 Advance Child Tax Credit payments since July.

That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August child tax credit money. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. How much will parents receive in September.

Monthly checks have ended for now. Whether or not another IRS glitch is. After eight days of delay some families said they finally began seeing money for the Sept.

The first half of the credit is being delivered in monthly direct deposits from July through December of 300 for children under 6 and 250 for those aged 6 to 17. Eligible families who do not opt-out will receive 300 monthly for each child under 6. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax.

Eligible families who do not opt-out will receive 300 monthly for each child under 6. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

What To Know About The First Advance Child Tax Credit Payment

![]()

Child Tax Credit Payment Tracker What To Do If You Received 300 By Mistake Itech Post

Irs Child Tax Credit Issues Reported With September Payments Kvue Com

How The Expanded Child Tax Credit Reduces Child Poverty Public Policy Institute Of California

September Child Tax Credit Payments Being Sent To 35 Million Families

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

The New Child Tax Credit Does More Than Just Cut Poverty

/cdn.vox-cdn.com/uploads/chorus_asset/file/22957800/1235261204.jpg)

Child Tax Credit Extension Democrats May Lose Their Best Weapon Against Child Poverty Vox

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The American Families Plan Too Many Tax Credits For Children

Millions Of Eligible Families Did Not Receive Monthly Child Tax Credits While More Than 1 Million Ineligible Taxpayers Did Cnn Politics

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit Update Third Monthly Payment On September 15 Marca

Child Tax Credit United States Wikipedia